1. Overview

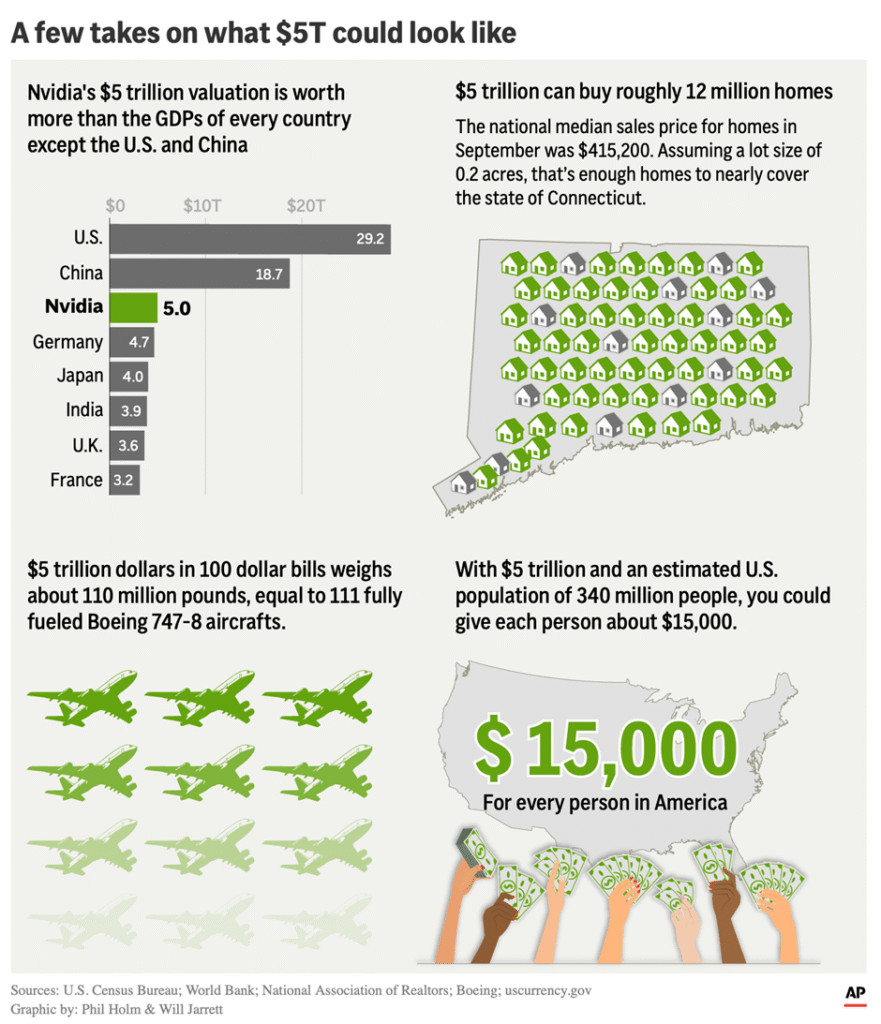

- Event: Nvidia becomes the first $5 trillion company in market capitalization.

- Date: Three months after crossing the $4 trillion mark.

- Significance: Highlights the AI-driven boom reshaping global technology and capital markets — often called the “AI Revolution”, comparable to Apple’s iPhone era (2007 onward).

- Upheaval being unleashed by an artificial intelligence craze that’s widely viewed as the biggest tectonic shift in technology since Apple.

- The ravenous appetite for Nvidia’s chips is the main reason that the company’s stock price has increased so rapidly since early 2023. On Wednesday the shares closed at $207.04 with 24.3 billion shares outstanding, putting its market cap at $5.03 trillion.

- On Tuesday, Huang disclosed $500 billion in chip orders. The company also announced a partnership with Uber on robotaxis and a $1 billion investment in Nokia, with the two planning to work together on 6G technology.

- In addition, Nvidia is teaming with the Department of Energy to build seven new AI supercomputers.

- Last month Nvidia announced that it will invest $100 billion in OpenAI as part of a partnership that will add at least 10 gigawatts of Nvidia AI data centers to ramp up the computing power for the owner of the artificial intelligence chatbot ChatGPT.

- Then, Nvidia announced last month that it’s investing $5 billion in Intel and will collaborate with the struggling semiconductor company.

2. Key Drivers of Growth

(a) Dominance in AI Hardware

- Nvidia pioneered Graphics Processing Units (GPUs) initially for gaming.

- Adapted GPUs to train AI systems like ChatGPT, image generators, and large language models.

- Massive demand surge as AI chatbots and data centers expanded globally.

- Tech companies are competing for limited chip supply, creating near-monopolistic pricing power.

- Chips are the new oil

(b) Early Technological Lead

- Nvidia’s CUDA platform and proprietary software ecosystem made its chips the industry standard for AI computing.

- High barriers to entry for rivals like AMD, Intel, and emerging Chinese firms.

3. Economic and Financial Implications

(a) AI Boom and Bubble Concerns

- Bank of England and IMF warn of possible AI asset bubble similar to dot-com euphoria.

- Valuations are being driven by speculative expectations of future AI profits.

- Nvidia CEO Jensen Huang dismisses bubble concerns, asserting that AI chatbots are transitioning from “interesting” to “profitable.”

(b) Return to Shareholders

- Nvidia returned $24.2 billion to shareholders (first half FY2026) via buybacks + dividends.

4. Global & Geopolitical Context

(a) APEC Summit, Gyeongju (South Korea)

- Jensen Huang attended the Asia-Pacific Economic Cooperation (APEC) meeting.

- Summit overshadowed by Trump–Xi Jinping bilateral talks amid a renewed U.S.–China trade war.

(b) U.S.–China Technology Tensions

- In August, Nvidia discussed a China-specific chip design with the Trump administration.

- Trump–Xi discussions at APEC to address Nvidia/AMD chip exports.

- Trump’s deal (Aug 2025): lift export controls → U.S. gets 15% cut of AI chip revenues sold to China.

- U.S. government took 10% stake in Intel ($11B).

- Nvidia later invested $5B in Intel to aid collaboration and stability.

5. Major Announcements & Partnerships

| Initiative | Value / Partner | Description |

| Chip Orders | $500 billion | Confirmed by Jensen Huang |

| Uber Partnership | Undisclosed | Collaboration on robotaxis |

| Nokia Partnership | $1 billion | Joint R&D on 6G technology |

| U.S. Department of Energy | — | Building 7 AI supercomputers |

| OpenAI Partnership | $100 billion | To add 10 GW Nvidia AI data centers for ChatGPT |

| Intel Collaboration | $5 billion investment | Joint semiconductor development |

6. Broader Tech and Economic Impact

- AI revolution is the new “tectonic shift” after smartphones.

- Generative AI (text, image, video, code) demands huge computing power, creating “chip gold rush.”

- Data centers emerging as new economic infrastructure similar to oil refineries of the past.

- Stock market concentration: Nvidia, Apple, Microsoft now dominate global equity indices.