GLP-1 (Glucagon-Like Peptide-1) is a hormone naturally produced in the human gut following a meal. It is critical for regulating blood sugar levels and managing appetite.

GLP-1 Agonists are a class of medications designed to mimic this hormone. Although originally intended for Type 2 Diabetes management, they are now widely used for weight loss due to their effectiveness in appetite suppression.

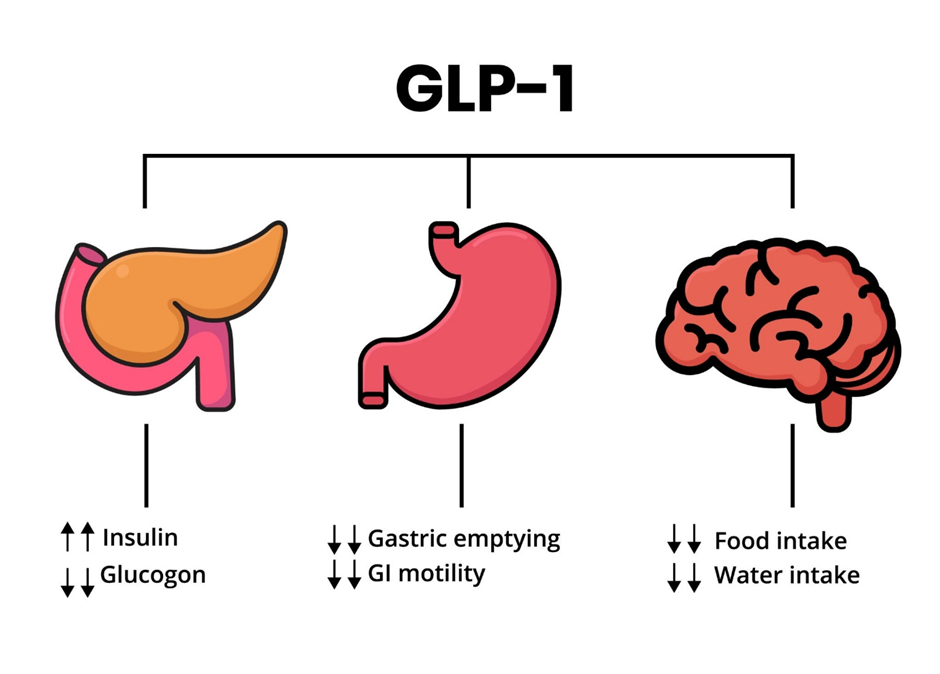

Mechanism of Action:

- Insulin Stimulation: Signals the pancreas to release insulin when blood sugar levels are elevated.

- Glucose Suppression: Prevents the liver from producing and releasing excess glucose into the bloodstream.

- Satiety Signaling: Slows gastric emptying (the speed at which food leaves the stomach) and targets brain receptors to create a prolonged feeling of fullness.

GLP-1 Sales & Market Landscape in India

The Indian pharmaceutical market has seen a dramatic shift in 2025, moving from grey-market reliance to a booming official sales sector dominated by two major global players: Eli Lilly and Novo Nordisk.

1. Market Leadership: The Rise of Mounjaro

- Top Pharmaceutical Brand: In October 2025, Eli Lilly’s Mounjaro (Tirzepatide) became the number one pharmaceutical brand in India by sales value, surpassing long-standing leaders like the antibiotic Augmentin.

- Revenue Performance: The drug generated approximately ₹100 crore ($11.4 million) in sales within a single month.

- Competitive Advantage: Demand for Mounjaro is significantly outpacing competitors because it uses a dual-action formula (targeting both GLP-1 and GIP receptors), which is associated with faster and more significant weight loss results compared to single-hormone treatments.

2. Novo Nordisk’s Strategic Response

- Wegovy Launch: To counter Eli Lilly, Novo Nordisk officially introduced its flagship weight-loss injection, Wegovy (Semaglutide), to the Indian market in 2025.

- Pricing Strategy: Following the launch, the company initiated price reductions to make the drug more competitive against the surging popularity of Mounjaro.

- Oral Market Dominance: despite the competition in injectables, Novo Nordisk retains a stronghold in the oral segment. Rybelsus (oral Semaglutide) accounts for roughly 69% of the anti-obesity market volume.

- Distribution Expansion: Partnerships with domestic firms like Emcure Pharmaceuticals have been established to extend distribution networks into Tier-2 and Tier-3 cities.

3. Sector Growth and Ecosystem

- Market Expansion: The anti-obesity drug market in India has seen exponential growth, expanding from ₹133 crore in 2021 to over ₹576 crore by March 2025.

- Diagnostic Integration: The surge in usage has created a secondary market for diagnostics. Major lab chains now offer specialized “GLP-1 Health Check” packages to monitor liver function, kidney health, and muscle mass for patients on these long-term medications.

4. The Outlook: Generic Competition

- Patent Expiry: The patent for the Semaglutide molecule in India is approaching expiry around 2026.

- Domestic Generic Entry: Major Indian pharmaceutical companies, including Cipla, Dr. Reddy’s, and Sun Pharma, are preparing to launch generic versions. This is expected to drastically reduce costs and transform these drugs from premium products into mass-market treatments.

GLP-1 Drugs in India

| Drug Molecule | Brand Name | Manufacturer | Status in India |

| Tirzepatide | Mounjaro | Eli Lilly | #1 by Revenue. Dual-action injection. |

| Semaglutide | Wegovy | Novo Nordisk | Available. Recently launched injection. |

| Semaglutide | Rybelsus | Novo Nordisk | Volume Leader. The only oral pill option. |

| Semaglutide | Ozempic | Novo Nordisk | Pending/Grey Market. Often used off-label. |

| Liraglutide | Saxenda | Novo Nordisk | Legacy Option. Daily injection; losing market share. |

-

What is GLP-1

GLP-1 (Glucagon-Like Peptide-1) is a hormone naturally produced in the human gut following a meal. It is critical for regulating blood sugar levels and managing appetite. GLP-1 Agonists are a class of medications designed to mimic this hormone. Although originally…

Leave a Reply